Bitcoin Mining Overview

Bitcoin Mining Insights:

-

Miners currently receive 6.25 Bitcoins (equivalent to approximately $152,000 as of March 2023) for successfully validating a new block on the Bitcoin blockchain.

-

The process of creating Bitcoin consumes a staggering 121 terawatt-hours of electricity annually, exceeding the energy consumption of entire countries like the Netherlands or the Philippines, as indicated by the Cambridge Bitcoin Electricity Consumption Index.

-

Mining a single bitcoin would demand the equivalent electricity usage of a typical household over nine years, based on data from August 2021.

-

Bitcoin's price has exhibited extreme volatility over time, with fluctuations from as low as $4,107 in 2020 to an all-time high of $68,790 in November 2021. As of March 2023, it was trading at around $24,300.

-

The probability of a modestly powered solo miner successfully solving a Bitcoin hash was approximately 1 in 26.9 million in January 2023, depending on their computing power and that of other miners.

-

The largest Bitcoin mining contributors as of January 2022 were the United States (37.4 percent), Mainland China (18.1 percent), and Kazakhstan (14.0 percent), according to the Cambridge Electricity Consumption Index.

Understanding Bitcoin:

Bitcoin is among the most prominent cryptocurrencies, which are digital means of exchange existing exclusively online. Bitcoin operates on a decentralized network or distributed ledger that records cryptocurrency transactions. When networked computers, known as miners, validate and process transactions, new bitcoins are generated or "mined." Miners are rewarded with Bitcoin for their role in processing these transactions.

Profitability of Bitcoin Mining:

The profitability of Bitcoin mining varies and is contingent on several factors. Even if miners succeed, the substantial upfront equipment costs and ongoing electricity expenses make profitability uncertain. The electricity consumption of a single ASIC is comparable to that of half a million PlayStation 3 devices, as per a 2019 report by the Congressional Research Service.

Starting Bitcoin Mining:

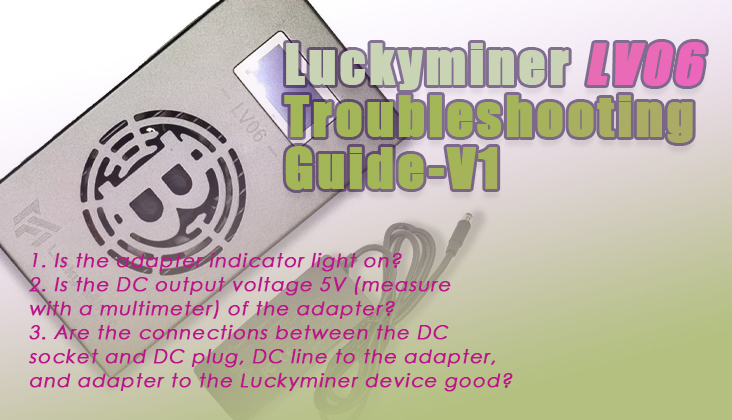

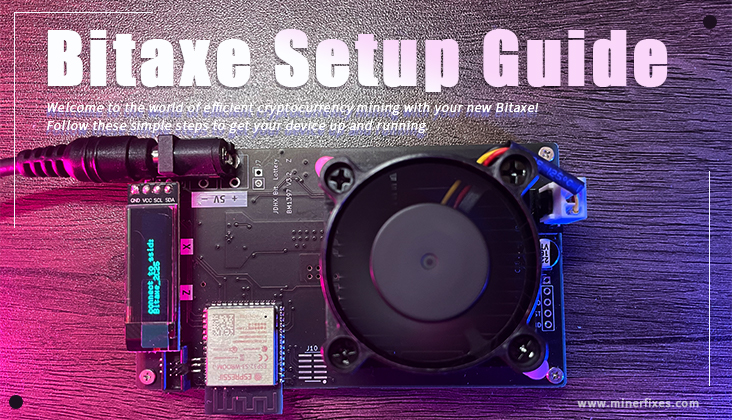

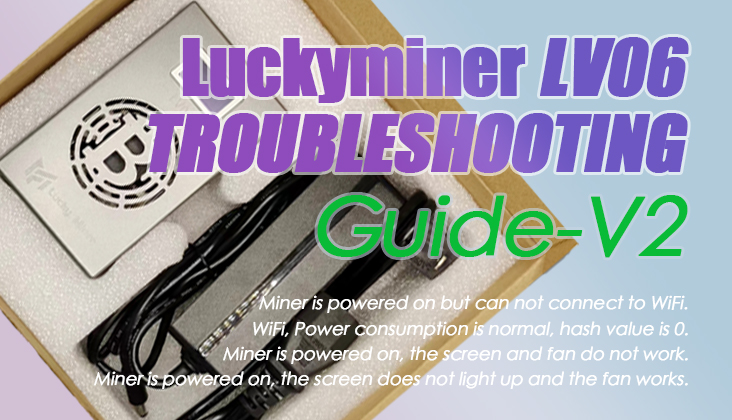

To embark on Bitcoin mining, you'll need the following essentials:

-

Wallet: This is where the Bitcoin you earn from mining will be stored. Wallets are encrypted online accounts that enable you to store, transfer, and receive Bitcoin or other cryptocurrencies. Companies like Coinbase, Trezor, and Exodus offer various wallet options for cryptocurrencies.

-

Mining Software: Numerous mining software providers offer free downloads compatible with Windows and Mac computers. Once connected to the necessary hardware, this software facilitates Bitcoin mining.

-

Computer Equipment: The most cost-intensive aspect of Bitcoin mining involves the hardware. A potent computer with substantial electricity consumption is essential for successful Bitcoin mining. Hardware costs can often surpass $10,000 or more.

Risks of Bitcoin Mining:

-

Price Volatility: Bitcoin's price has exhibited significant fluctuations since its inception in 2009. Recent trading values have ranged from less than $20,000 to nearly $69,000 in November 2021, adding uncertainty for miners trying to balance rewards against high operational costs.

-

Regulation: Governments worldwide have displayed varying degrees of skepticism and regulation toward cryptocurrencies, with some countries banning or restricting cryptocurrency mining activities. This regulatory uncertainty poses a risk to miners.

Taxes on Bitcoin Mining:

Tax considerations are paramount for Bitcoin miners:

-

Business vs. Hobby: If Bitcoin mining constitutes a business, expenses may be tax-deductible, and revenue would be determined by the value of the earned bitcoins. However, if mining is a hobby, deductions are less likely.

-

Mined Bitcoin Taxation: Successfully mined bitcoins are considered income, and their fair market value at the time of receipt is subject to taxation at ordinary income rates.

-

Capital Gains: Selling bitcoins for a price higher than the acquisition cost qualifies as a capital gain, subject to taxation similarly to traditional assets like stocks or bonds.

87919.19USD

87919.19USD 68.17USD

68.17USD 1.87USD

1.87USD 0.12USD

0.12USD 2952.28USD

2952.28USD 11.29USD

11.29USD 896.1USD

896.1USD 122.91USD

122.91USD 0.11USD

0.11USD 0.04USD

0.04USD 0.12USD

0.12USD

Favorites

Favorites History

History